For faster development of our finance professionals and better match with client

ConQuaestor's motto is: improving your performance. A slogan that relates to both the finance professional and the organization where the professional will be working. To further strengthen this promise, we will be working with Competence Circles and Competence Cards. A very insightful method to determine where a finance professional, from trainee to principal, stands in terms of development and where he wants to develop further. And a method that helps clients select the finance professional with the desired competencies.

What are Competence Circles?

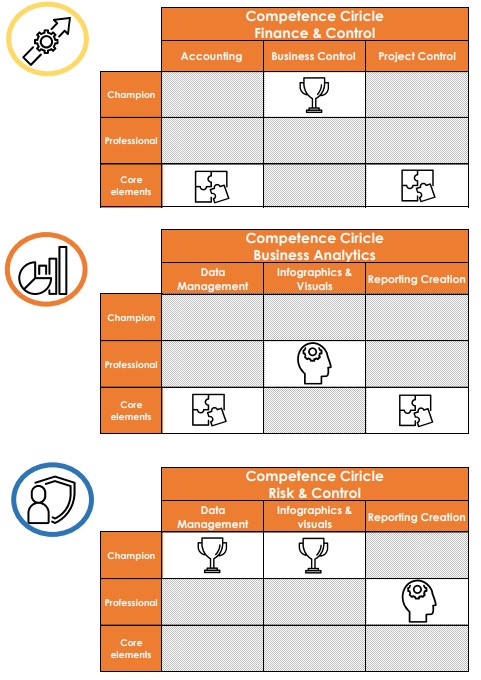

The scope of work of our finance professionals focuses on three sub-areas: Finance & Control, Risk & Control and Business Analytics. These three areas overlap and are constantly evolving. The specialist in Risk & Control must therefore also know something about Business Analytics and Finance & Control. And regularly receive further training in their own specialism. From that specialization, they join one of the three Competence Circles.

The power of Competence Circles

Working with Competence Circles gives our finance professionals the opportunity to develop specialist skills without losing sight of general developments within finance. Together with fellow specialists, they meet regularly to follow professional developments. This can be attending a training course, obtaining a certificate, a presentation by a guest speaker or sharing among themselves the approach to specific projects from daily practice.

In addition, meetings are organized where all finance professionals are welcome, as what is covered is of a more general nature.

For finance professionals who want to develop themselves more generally or move toward an overarching management position, the more general meetings are also open to professionals from the two other Competence Circles. The advantage is that they can share additional experiences with the specialists from their own expertise.

But professional knowledge alone will not get them there. Soft skills and personal development are just as important. So in that area, too, the professionals are given the opportunity to develop.

This set-up ensures a balanced and coherent offer in the development of the finance professional. Those who wish can specialize extensively or develop broadly in general.

Developing within a Competence Circle

Circle Contents have been established for each domain. These are the subjects/subjects that are central within a Competence Circle. Thus, the professionals know which competencies and knowledge they have sufficiently developed and what they still have to i.c. can work on.

Within the Competence Circles, information, knowledge and skills are shared, categorized by:

- Expertise and technology

- Soft controls

- Practical Experience

This ensures a balanced and cohesive offering by Circle Content.

Establish competence profile in Competence Card

Now that we have determined the prerequisites, it is important to determine where the needs of our professionals lie. And what the current and desired competency profile looks like. We incorporate this into a Competence Card. A profile based on a mix of knowledge, skills and abilities per Competence Circle that the professional already possesses. én a mix in which the professional will need or want to develop further.

There are two sides to this need. First of all, we require all our professionals, depending on their seniority, to have a basic profile. Simply to be able to function as a fully-fledged interim finance professional. The transition from junior to medior and from medior to senior also requires additional knowledge and skills. Certain assignments and/or clients may require additional qualifications. If a professional wants to be considered for such an assignment, and does not yet have such qualifications, ConQuaestor offers a development program within the Competence Circles.

Better matching with the Competence Card

Working with Competence Cards offers several advantages when matching the right candidate to the right job:

- In a uniform manner, finance professionals are determined to what extent they meet the qualifications required to perform the job well.

- They show in a clear, visual way the development of the professional's competencies.

- The Competence Card is equipped with Competence Goals, this clearly shows which competencies the professional needs to work on. It indicates which courses, e-learnings and workshops they should take and what type of assignment supports the development of the professional.

- In addition to a resume, the client gets a clear picture of what mix of competencies the proposed professionals possess which simplifies the choice of best-fit professional.

Due to the uniform design of the Competence Cards, they also function as a talking plate towards the client. They can now indicate much more concretely what they are looking for in a finance professional for a specific assignment. The conversation goes beyond desired experience and education, it leads to competencies.

Competence levels

The Competence Card shows the competency level on the different components. They have the following levels:

- Champion: the competencies of the finance professional are at expert level

- Professional: competencies are at all-round professional level

- Core elements: the competencies are at the basic level

Incidentally, it is not that we strive for all of our professionals to be at the champion level in all areas. Nor is that feasible, given the rapid developments within the field. The starting point is that the professional meets the qualifications needed to perform a specific assignment. Every assignment requires different qualities. It is up to the client to determine which qualifications are needed and to ConQuaestor to find the right candidate.

Competence Circle Cycle

Precisely because developments within finance are so rapid, it is important to evaluate competencies annually and adjust them as necessary. Think of new digital programs coming on the market that the professional needs to master. While other programs disappear from the market, no longer requiring certification. We see the same with certain theories that make their appearance or prove outdated and learnings we draw from cases.

We review the Competence Circles and associated Circle Content using the Competence Circle Cycle below.

The steps of the Competence Circle Cycle are as follows:

- Throughout the year, we closely monitor developments in the market. We ask our professionals what developments they see and what consequences this has for the execution of their assignments. New competencies are added and obsolete competencies removed.

- The training coordinator adjusts the training curriculum as needed and looks for matching training, courses and/or workshops. If these are not available, they are established with the senior consultants.

- Developments are incorporated into the various Competence Circles. Where necessary, the Competence Content is adapted to the new developments.

- In consultation with the finance professional, we make the desired outcome agreements. What competencies does the professional need to work on to keep up to date in the field and for personal development? And in which areas does he want to develop to a higher level? Or the other way around, what type of assignment does the professional aspire to and what competencies go with it?

- Throughout the year, we evaluate competency growth with the professional. Is everything going according to plan? Is the professional lagging behind in parts? Or does his or her assignment require additional competencies?

- Those outcomes of those conversations, in turn, provide input for step one, tracking market developments.

Benefits of working with the Competence Circles

With the introduction of these Competence Circles and associated Competence Cards, we are better able to professionally prepare our finance professionals for personal and market developments. And it makes it easier for clients to indicate which conditions a professional must meet in order to perform the assignment well.

Because an assignment requires professionals with different qualities and competencies, it now becomes easier to assemble the right team. The client indicates what the assignment involves and what the specific objectives are. Together with ConQuaestor's business manager, these are converted into competencies. Depending on the scope of the assignment, one or more finance professionals are sought who (collectively) possess the required competencies.

Because a Competence Card of all our finance professionals has been developed, it is now much easier to find the right candidates for the right assignments. This too as part of our motto: improving your performance.

Want to know more?

Want to know more about the Competence Circles? Or about the impact on our professional? You can do so by sending a message to Martijn Bins (martijn.bins@conquaestor.nl) or by calling +31 (0)6 1218 0868.